Meta Platforms Inc., the parent company of social media giants Facebook, Instagram, and WhatsApp, has been a dominant player in the tech industry for years. As a publicly traded company, Meta's stock price is closely watched by investors and analysts alike. In this article, we will delve into the current Meta stock price, its historical trends, and the factors that influence its performance.

Current Meta Stock Price

As of the latest market update, the

Meta stock price is trading at around $230 per share. The company's stock is listed on the Nasdaq stock exchange under the ticker symbol META. With a market capitalization of over $650 billion, Meta is one of the largest publicly traded companies in the world.

Historical Stock Price Performance

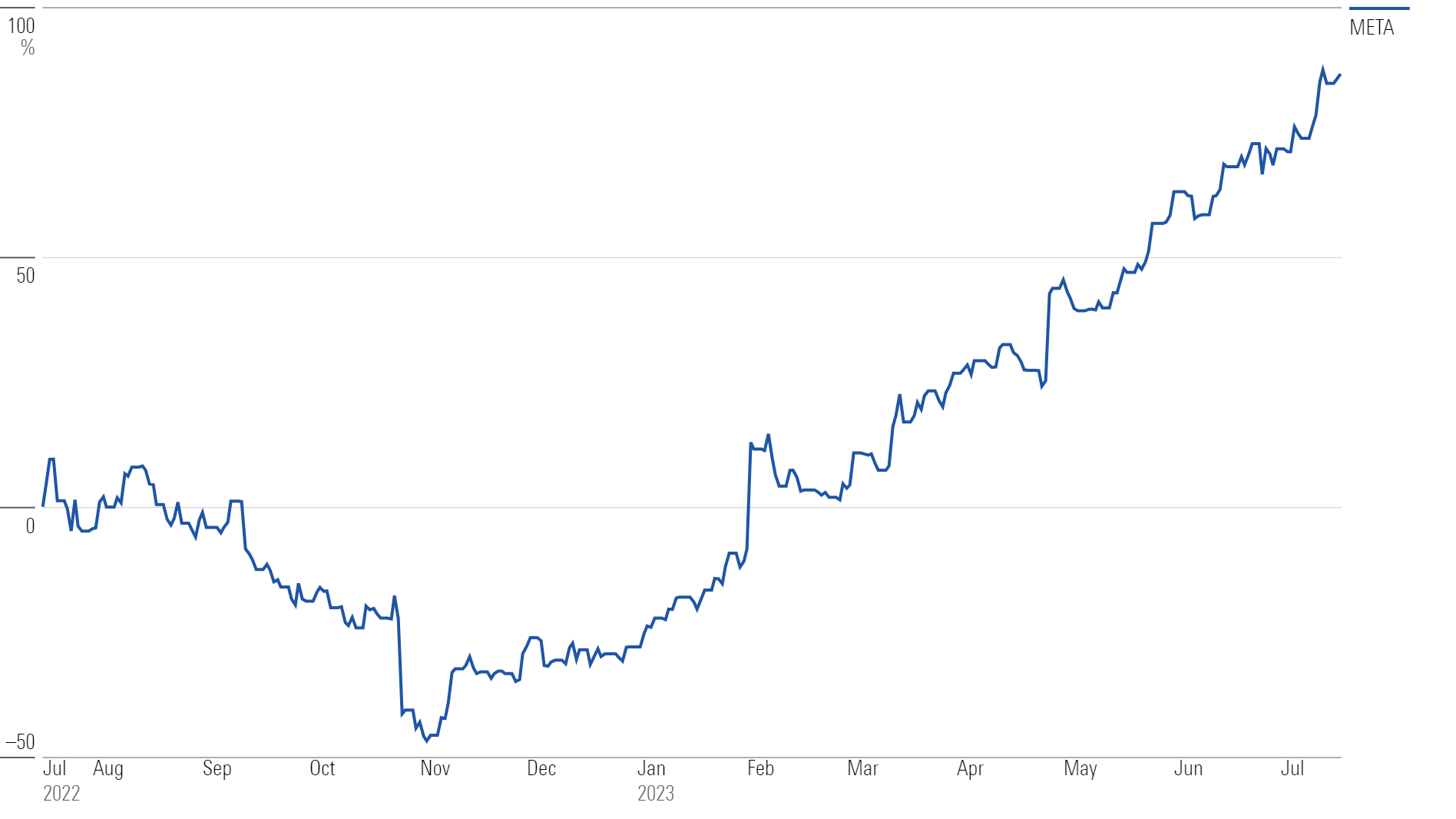

To understand the current Meta stock price, it's essential to look at its historical performance. Over the past year, Meta's stock has experienced significant fluctuations. The company's stock price reached an all-time high of $384 per share in September 2021, but it has since declined due to various factors, including increased competition, regulatory scrutiny, and concerns over user growth.

Despite the decline, Meta's stock has shown resilience and has managed to recover some of its losses. The company's strong financials, including revenue growth and increased profitability, have contributed to the recovery.

Factors Influencing Meta Stock Price

Several factors influence Meta's stock price, including:

Advertising revenue: As a major player in the digital advertising space, Meta's stock price is heavily influenced by its advertising revenue. Any changes in ad revenue can significantly impact the company's stock price.

Regulatory environment: Meta has faced increased regulatory scrutiny in recent years, particularly with regards to user data privacy and antitrust concerns. Any changes in regulations or lawsuits can impact the company's stock price.

User growth: Meta's stock price is also influenced by user growth across its platforms, including Facebook, Instagram, and WhatsApp. Any decline in user growth can raise concerns among investors and impact the stock price.

Competition: The tech industry is highly competitive, and Meta faces competition from other social media platforms, such as TikTok and Snapchat. Increased competition can impact Meta's stock price.

In conclusion, the Meta stock price is a complex and dynamic entity that is influenced by a variety of factors. While the company's stock has experienced fluctuations in the past, its strong financials and dominant position in the tech industry make it an attractive investment opportunity. As the company continues to evolve and adapt to changing market conditions, investors will be closely watching the Meta stock price to see how it performs in the future.

If you're interested in staying up-to-date with the latest Meta stock price and news, be sure to check out

Nasdaq for the latest updates.

Meta Platforms Inc. stock quote (U.S.: Nasdaq) is a valuable resource for investors and analysts looking to stay informed about the company's performance. With its strong brand recognition, diverse revenue streams, and commitment to innovation, Meta is well-positioned for long-term success. Whether you're a seasoned investor or just starting to explore the world of stocks, Meta is definitely worth keeping an eye on.

Note: This article is for informational purposes only and should not be considered as investment advice. Always consult with a financial advisor before making any investment decisions.